“Conservation will ultimately boil down to rewarding the private landowner who conserves the public interest.”

– Aldo Leopold

The Ontario Managed Tax Incentive Program is a provincial government tax relief available to qualifying land owners.

MFTIP Quick References:

How much will I save on my property taxes?

Are there any grants or subsidies available to cover planning costs?

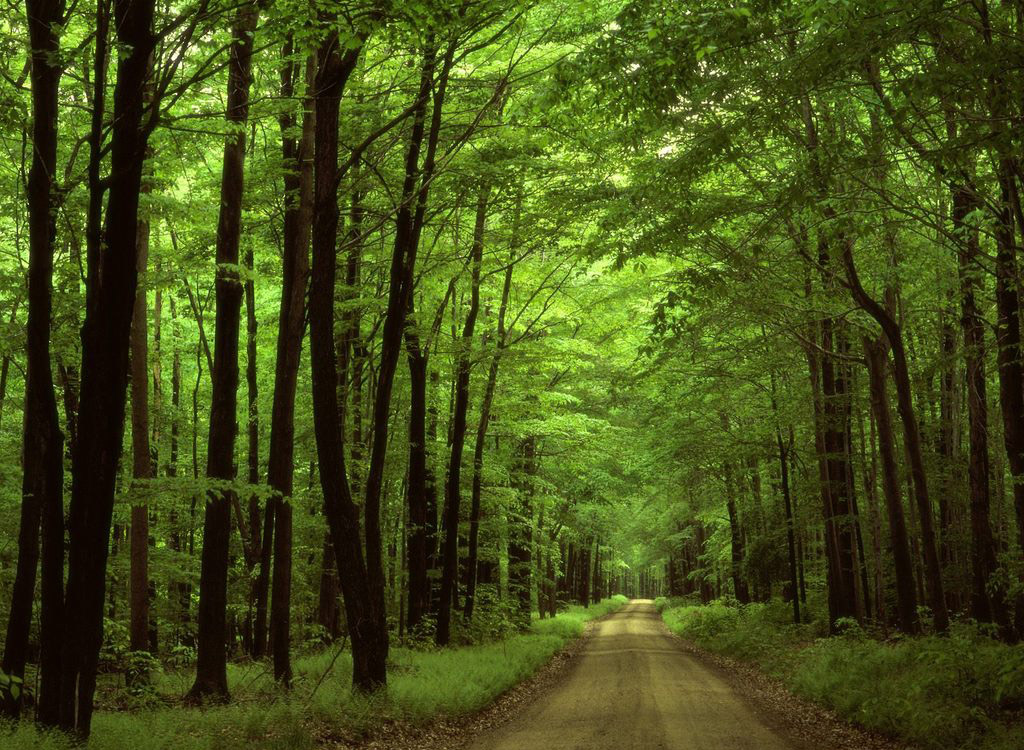

If you value your forested property, whether its the family woodlot, the cottage, an investment property, or your own backyard, there are many ways you can manage sustainably and profitably. The MFTIP program can help you accomplish this by reducing property taxes for your forests covered by an approved Forest Management Plan.

Participating properties are reclassified as ‘Managed Forest’ for tax purposes – and are taxed at 25% of the standard Residential rate. So if your forested land is currently classified as Residential, you could save up to 75% off your property taxes.

Assistance with tree planting, harvesting, and the improvement of your forest’s health are available through a range of government and private services we can help connect you with, as we help you build a 10-year plan for your property.

Requirements:

- Own 9.88 acres (4 hectares) or more of forested land on a single property.

- Have a minimum number of trees on each hectare (acre) of forest you own*.

- Be a Canadian citizen or permanent resident, or:

- be a Canadian corporation or partnership, or

- be a trust or conservation authority

- Submit a Forest Management Plan approved by a certified Managed Forest Plan Approver (us!).

Obligations

As a successful participant in the MFTIP program, you’re required to provide an update report after 5 years. This can be done easily online or with the assistance of one of our staff.

At 10-years, the plan must be reviewed and renewed, taking into account the changes and growth of the last decade and adjusting the plan for the next ten years.

Deadlines:

New Applicants must have their approved plans submitted to the MNRF before 30 June in order to receive tax credits for the following year.

5-year reports, and 10-year renewals are due before 31 July of the appropriate year.

Our Services & Fees

We offer turn-key service for the entire MFTIP program enrollment process. We work with you to document the history of your property, and your goals and priorities as a land-owner. Then we perform a comprehensive inventory of your forest, documenting the tree, shrub, ground vegetation and wildlife species present on the land, as well as important features such as soil composition, drainage and topography. Additional information such as the history of the region, the surrounding forest landscape and the presence of potential conservation zones and sensitive sites, are thoroughly researched.

We take that information and build a qualitative forest management plan for your property. One which meets all of the requirements of the MFTIP program, and provides you with a detailed understanding of your landscape. The plan also lays a roadmap for forest management over the following 10 to 20 year window and identifies how you can improve and enrich your forest. We complete all of the administrative steps to review and approve the plan, and submit it to the MFTIP program.

Fees

Our fees vary according to the size, location and composition of each property. With planning costs offset by future property tax savings, our services generally pay for themselves within 2-3 years of the plan’s 10-year lifespan.

If you meet the requirements above, are interested in having a Forest Management Plan developed, or in learning more about the MFTIP Program, please contact us for a free, no-obligation quote.

How much will I save on my property taxes?

The amount saved varies by property, and is ideal for residential or large non-farm properties not already zoned as conservation land. The tax rate for Managed Forest land is only 25% of the normal residential rate. However if you have a residence on the property, a large part of your tax bill will be for the building itself. You will still see the land on the property taxed at a reduced rate, but the tax cost of any buildings or residences will remain the same, as will any non-forested sections of the property.

At this time it is not possible to provide exact estimates, as overall property taxes change annually and are determined using multiple factors. For more information, please visit the Municipal Property Assessment Corporation – who set the values of properties in Ontario for tax purposes.

Are there any grants or subsidies available to cover planning costs?

There are a variety of grants, subsidies and support services available through Ontario’s many different forestry, environmental and conservation authorities. Depending on where your property is located you may be eligible for one or more of these.

Let us know where you are located, and we can connect you with the available services.

A major option for Eastern Ontario is the Rural Clean Water Program, which is administered by the City of Ottawa and the regional Conservation Authorities for the surrounding watersheds. This great program will cover up to 75% (to a maximum $750) of your planning costs. This grant is only available in certain areas, and conditions may apply. Please contact us for more details.

What’s the Catch?

No Catch. Participation in the MFTIP program is voluntary and you can withdraw at any time. If your property is sold or changes owners, the new owners are able to continue the Forest Management Plan and its tax benefits, so long as they apply to the MNRF within 60 days.

Withdrawal from the program will see the tax evaluation for the forested property revert to its former classification for subsequent tax bills.

Learn More / Important Links

Please visit the MFTIP homepage for more information on the program and its requirements.